Four Types Of Policies For Your Home In Dallas

See How We're Different

or call us: (214) 253-0570

Now that you know how you should value your home for insurance, I’m going to take a few moments to tell you about some insurance coverage options for your home. In Texas, there are several different types of insurance policies, and today we will talk about four of the options you have to choose from. These are not all of your options, but they are the main four you will most likely encounter (and no, State Farm is not a magical policy not offered elsewhere). Each type of policy has its ins and outs, so take a few minutes to read about what kinds of choices are available to you when you purchase a homeowner’s insurance policy in Dallas or anywhere.

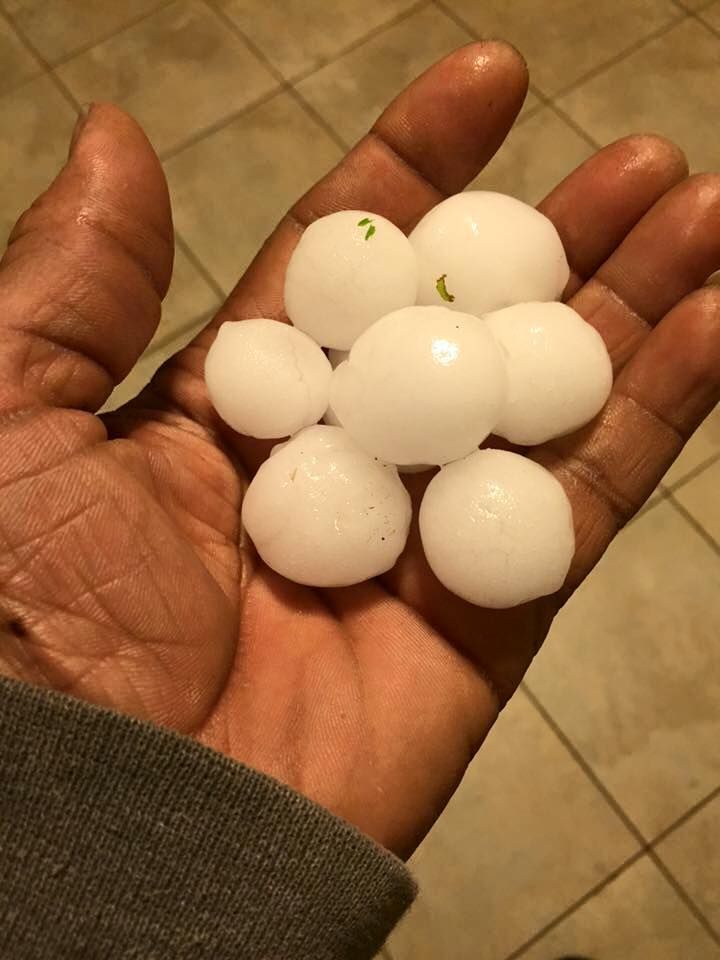

1. The most basic type of home policy is a “Dwelling Fire” policy. Dwelling fire policies cover a very limited list of risks, with the most basic covering your home for fire only. These are generally intended for investment type properties, because they typically do not cover your personal propery inside the structure. If you want to just cover your home for the most basic of perils, this is what you want. I wouldn’t choose one of these policies without making sure that your home is covered for at least fire and wind. In Dallas, we get plenty of hail, and if you want your home policy to cover the roof, make sure you request that coverage as well. I certainly wouldn’t recommend this for your home, as the difference in price between a dwelling fire policy and an actual homeowner’s policy is usually negligible.

2. The standard homeowner’s policy (and the minimum type of coverage we recommend for someone living in a house) is an HO-A type policy. An Ho-A policy covers wind, hail, fire, and theft, along with other named perils. The big thing missing from an HO-A type policy is sudden and accidental water damage – like if your dishwasher breaks. An HO-A policy with replacement cost coverage is a good solid basic type of insurance policy for your home.

3. The Ho-3 policy is a more comprehensive policy, that generally automatically includes some futher coverages. Things like foundation water damage coverage, accidental water damage, and replacement cost content coverage are generally included with the HO-3. An HO-3 type policy is more of an “open” perils type policy – that means it covers more – though the limits offered for some of the extended coverage can be can be farly low.

4. The Ho-B policy. This is the Big Daddy home policy in Texas. The HOB is the most comprehensive type policy you can get for your home – it covers your house on an “all perils’ basis, meaning that unless it is specifically excluded, it’s covered. An HO-B comes with replacement cost coverage for your things and your house, it covers water damage and quite often includes some mold coverage. The HOB is generally only available to newer homes, usually no home built more than 30 years ago is eligible for this plan.

There are lots of choices when it comes to home insurance – especially here in the Dallas area. Make sure you are informed when buying home insurance; quite often, the HO-A from one company might be within a few dollars of another company’s HO-3. More coverage is always better in my eyes, but then again I am an insurance guy.

The Phoenix Insurance – Homeowners Insurance In Dallas