Texas Transmission Shop Insurance

See How We're Different:

or Call Us: (214) 253-0570

Most Common Business Policies

Index

Contact Us

Operating a transmission shop in Texas involves a myriad of responsibilities, one of the most critical being the need for appropriate insurance coverage. This guide aims to provide a comprehensive overview of transmission shop insurance, helping business owners make informed decisions.

Understanding Transmission Shop Insurance

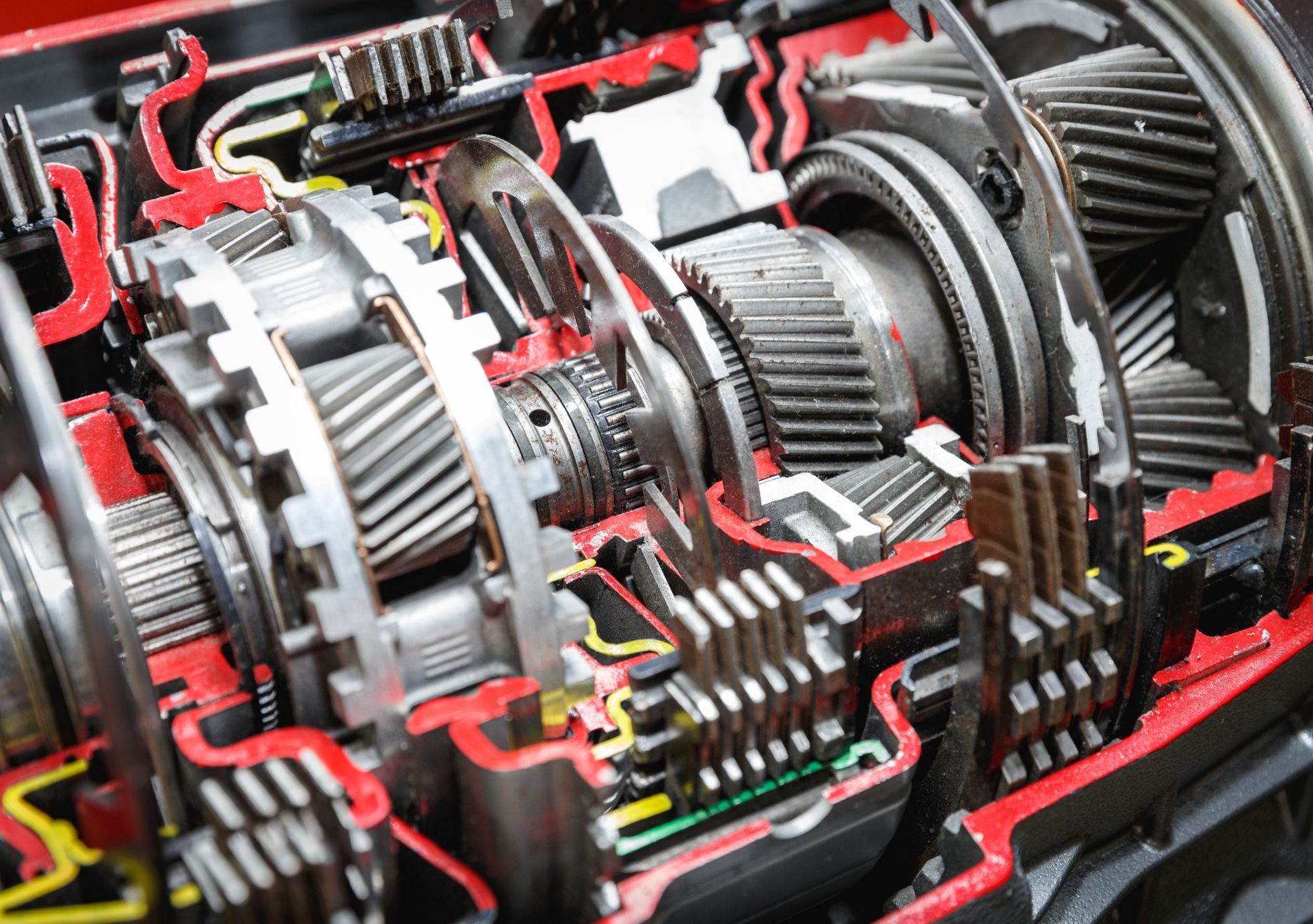

Transmission shop insurance is specifically tailored to meet the needs of automotive repair businesses that specialize in transmission services. This type of insurance protects shop owners from various risks associated with their operations, including liability for injuries, property damage, and equipment loss.

Moreover, it encompasses several types of coverage that work together to foster a safer and more secure environment for both the business and its customers. Having adequate insurance is not just a legal requirement; it’s a safeguard against potential financial hardships. In an industry where the unexpected can happen at any moment, such as equipment failure or customer disputes, having a robust insurance policy can mean the difference between a thriving business and one that struggles to recover from setbacks.

Importance of Transmission Shop Insurance

The importance of transmission shop insurance cannot be overstated. Without it, shop owners could be personally liable for any accidents or damages incurred during business operations. This could include everything from a client slipping on wet floors to damage caused by faulty repair work. The financial repercussions of such incidents can be devastating, potentially leading to lawsuits that drain resources and tarnish reputations.

Insurance serves as a protective barrier, ensuring that business operations can continue smoothly even in the face of unforeseen circumstances. Additionally, it instills trust among customers, as they feel more secure knowing that their service provider is properly insured and capable of addressing any potential issues that may arise. This trust can translate into repeat business and referrals, which are crucial for the growth and sustainability of any transmission shop. Furthermore, many insurance providers offer risk management resources and training, which can help shop owners implement safety measures and reduce the likelihood of accidents occurring in the first place.

Key Components of Transmission Shop Insurance

Transmission shop insurance typically includes several key components, such as:

- General Liability Insurance: Covers bodily injury, property damage, and legal fees in case of lawsuits.

- Property Insurance: Protects physical assets like tools, equipment, and the shop building itself.

- Workers’ Compensation Insurance: Mandatory in Texas, it provides coverage for employees who get injured on the job.

- Garage Liability Insurance: Specifically for automotive businesses, it covers incidents related to vehicles in the shop's care.

Professional Liability Insurance: Addresses claims of negligence or failure to perform professional duties.

Understanding these components is pivotal in ensuring that your transmission shop is adequately protected against various types of risks. Each type of coverage plays a unique role in safeguarding the business, and shop owners should work closely with insurance agents to tailor their policies to fit their specific needs. For instance, a shop that frequently handles high-performance vehicles may require additional coverage to protect against the unique risks associated with those services. Furthermore, staying informed about changes in regulations and industry standards can help shop owners adjust their insurance coverage accordingly, ensuring they remain compliant and protected as their business evolves.

Texas-Specific Insurance Requirements

Each state has its specific requirements regarding insurance for businesses, and Texas is no exception. Transmission shop owners must be aware of the local regulations and guidelines governing their insurance policies.

State Regulations for Transmission Shop Insurance

In Texas, businesses are required to maintain certain types of insurance to operate legally. For instance, while general liability insurance isn’t mandated by law, it is heavily recommended to protect your assets.

However, workers’ compensation insurance is mandatory for businesses that employ one or more employees. Additionally, any business that handles vehicles must carry certain insurance types dedicated to protect against the liabilities associated with automotive servicing. This includes garage liability insurance, which specifically covers damages or injuries that occur on the premises, as well as coverage for tools and equipment used in the repair process.

Complying with Texas Insurance Laws

Compliance with Texas insurance laws involves ensuring that all required insurance policies are active and appropriately cover the operations conducted at the shop. This includes having proof of workers’ compensation coverage and ensuring that any vehicle-related insurance meets the state's minimum requirements. It’s also crucial to review your policies regularly, as changes in your business operations or the types of services offered may necessitate adjustments to your coverage.

Failure to comply with state regulations can lead to significant fines and penalties, as well as the interruption of business operations. It is essential for business owners to stay updated on changes in local legislation to ensure continued compliance. Furthermore, engaging with a knowledgeable insurance agent can provide valuable insights into the best coverage options tailored to the unique needs of a transmission shop, helping to mitigate risks and enhance overall business security.

Choosing the Right Insurance Policy

Selecting the right insurance policy for your transmission shop requires careful consideration of various factors that can influence coverage needs and costs. Making an informed choice can significantly impact your business's financial stability.

Factors to Consider When Selecting a Policy

When choosing an insurance policy, shop owners should consider the following factors:

- Type of Coverage Required: Identify what type of coverage is necessary based on the services provided and potential risks.

- Coverage Limits: Make sure the policy limits are adequate to protect your assets in case of a major incident.

- Deductibles: Understand how much you would need to pay out of pocket before the insurance kicks in.

- Premium Costs: Compare quotes from different providers and assess which offers the best value for money.

- Insurer’s Reputation: Research and select a reputable insurance company that specializes in commercial insurance for automotive businesses.

Taking these factors into account will help ensure that you select a comprehensive insurance policy that suits the specific needs of your transmission shop. Additionally, it’s wise to consider the unique aspects of your business, such as the types of vehicles serviced and the specific equipment used. For instance, if your shop specializes in high-performance vehicles, you may need specialized coverage that addresses the unique risks associated with those services. Furthermore, think about the potential for business interruption due to unforeseen events, such as natural disasters or equipment failure, which could impact your revenue.

Understanding Policy Terms and Conditions

Before finalizing any insurance policy, it’s crucial to thoroughly review the terms and conditions. This document outlines what is and isn’t covered, exclusions, and the procedures for filing claims.

Understanding these terms can prevent costly misunderstandings in the future. It is recommended to discuss any ambiguities with your insurance agent to clarify any concerns regarding coverage, limits, and other key details of the policy. Additionally, pay attention to the policy's renewal terms and any changes in coverage that may occur over time. Some policies may have automatic renewals with adjusted premiums, so being proactive about reviewing your policy annually can help you stay informed about your coverage and costs. Consider also the availability of endorsements or riders that can enhance your policy, providing additional protection for specific risks that may not be covered under a standard policy.

Costs Associated with Transmission Shop Insurance in Texas

The costs related to transmission shop insurance can vary widely depending on multiple factors, including the size of the shop, types of services offered, location, and claims history. Understanding these costs can help business owners budget effectively. In Texas, where the automotive repair industry is robust, having the right insurance coverage is not just a regulatory requirement but also a critical component of risk management. Transmission shops, in particular, face unique challenges due to the specialized nature of their services, which can affect their insurance needs and costs.

Estimating Insurance Premiums

Estimating insurance premiums requires gathering quotes from different insurance providers. Factors that typically influence premiums include the following:

- Location of the shop.

- Annual revenue of the business.

- Number of employees.

- Claims history specific to the shop.

- Types and amounts of coverage required.

Business owners should actively seek multiple quotes and review each to determine the best option for their specific situation. Additionally, it’s beneficial to understand the nuances of each policy, as some may offer specialized coverage options tailored for transmission shops, such as equipment breakdown insurance or coverage for customer vehicles in the shop. Engaging with an insurance broker who specializes in automotive repair can provide valuable insights into the best coverage options available in the market.

Ways to Reduce Insurance Costs

Finding ways to lower insurance costs is a common concern for many transmission shop owners. Here are several tips that may help:

- Increase Deductibles: By opting for a higher deductible, you can lower your premium payments.

- Bundle Policies: Many insurers offer discounts for bundling multiple types of coverage.

- Maintain a Good Claims History: Reduce the number of claims made over time to benefit from lower premiums.

- Invest in Safety Training: Implementing safety protocols can lower the risk of accidents and reduce premiums.

- Review Coverage Annually: Regularly re-evaluate your insurance needs to ensure you’re not overpaying for unnecessary coverage.

By actively managing these factors, transmission shop owners can work toward reducing their overall insurance costs while maintaining essential coverage. Additionally, establishing strong relationships with local suppliers and clients can lead to fewer risks and claims, as a well-connected shop is often better equipped to handle potential issues before they escalate. Furthermore, participating in industry associations or groups can provide access to shared resources and knowledge that can help shop owners stay informed about best practices in risk management and insurance savings strategies.

Filing and Managing Insurance Claims

Knowing how to properly file and manage insurance claims is essential for any business owner. Proper procedures can lead to quicker responses from insurance providers and mitigate potential financial strain during tough times. Understanding the intricacies of your insurance policy and the claims process can empower you to navigate challenges more effectively, ensuring that you are not left vulnerable in the face of unexpected incidents.

When and How to File a Claim

Filing an insurance claim should take place when an incident occurs that falls within the parameters of your coverage. Common examples include accidents at the shop, theft of tools or equipment, or damage to customer vehicles while under care. Each of these scenarios can have different implications for your business, making it crucial to understand the specifics of your coverage and the steps required to initiate a claim.

The process typically begins with notifying your insurance provider immediately, filling out the required claim forms, and providing documentation such as photos of the incident and any police reports if applicable. Prompt and thorough reporting helps ensure a smooth claims process. Additionally, keeping a detailed log of events related to the incident, including dates, times, and conversations with witnesses, can bolster your claim and provide a clearer picture of the situation to your insurer.

Dealing with Insurance Adjusters

After filing a claim, an insurance adjuster will be assigned to assess the situation. It's important to cooperate fully and provide any necessary information to facilitate their investigation. Adjusters are tasked with determining the validity of your claim and the amount that should be paid out, so being transparent and forthcoming can help build trust and expedite the process.

Be prepared to answer questions and provide any supporting documentation. Understanding your policy limits and terms can prepare you for negotiations if the claim amount is disputed. Maintaining clear communication with the adjuster can help expedite the claims process. Additionally, it may be beneficial to familiarize yourself with common tactics used by adjusters, such as requesting additional documentation or suggesting alternative resolutions, to ensure you are adequately prepared to advocate for your interests throughout the claims process. Remember, the more organized and proactive you are, the smoother the experience is likely to be, allowing you to focus on running your business effectively during challenging times.

Frequently Asked Questions about Transmission Shop Insurance in Texas

Business owners often have numerous questions about transmission shop insurance coverage, risks, and compliance requirements. Here are some frequently asked questions that might help clarify common concerns.

Common Misconceptions about Transmission Shop Insurance

One common misconception is that all insurance providers offer the same coverage. In reality, policies can vastly differ regarding specific coverage options and exclusions. It’s vital to thoroughly research and compare policies tailored for automotive repair businesses. For instance, some policies may include coverage for tools and equipment, while others may not, potentially leaving a shop vulnerable to loss in the event of theft or damage.

Another misconception is that smaller shops don’t need extensive coverage. Regardless of size, every transmission shop faces risks that can lead to substantial financial loss. Whether it’s a minor injury or significant property damage, all businesses should have the right level of insurance. Additionally, smaller shops may be more susceptible to certain risks, such as a lack of financial reserves to cover unexpected expenses, making comprehensive coverage even more critical.

Expert Advice on Transmission Shop Insurance

Gathering advice from experts in the field can help clarify any uncertainties. Insurance agents who specialize in automotive business insurance can provide tailored guidance based on your shop's unique needs. They can help identify potential gaps in coverage and suggest enhancements that can protect your business from unforeseen events, such as natural disasters or cyber threats that could compromise customer data.

Networking with other shop owners and attending industry workshops can offer insights into best practices and common challenges when dealing with insurance. Consider joining automotive trade organizations, which often provide resources and guidance on managing insurance effectively. These organizations can also keep you updated on legislative changes that may impact your coverage requirements, ensuring that you remain compliant while maximizing your protection. Furthermore, sharing experiences with peers can lead to discovering innovative solutions to common insurance-related issues, fostering a supportive community among transmission shop owners.

In conclusion, understanding and properly managing transmission shop insurance in Texas is integral to running a successful operation. By familiarizing yourself with the necessary policies, Texas-specific requirements, and effective claim procedures, you can safeguard your business and focus on providing stellar transmission services.